lisa fabrega

I speak to hundreds of women about money every year. Not just clients, but also women interested in working with me who book exploratory sessions. At the end of those conversations, we always talk about money and what they want to invest in working with me.

Ten years into this business, I’ve had around a thousand of these calls. And I’ve learned A LOT about the stealthy ways in which people sabotage their money and even reject money that is wanting to come to them.

The way a woman shows up for and reacts to the money part of her exploratory session often reveals a lot to me about why she’s experiencing money plateaus in the first place. Or if she’s happy with where her money is, it reveals to me HOW and WHEN she’s going to plateau eventually.

Today I want to share with you the wealth of insight I have learned from those thousands of conversations, in the hopes that they help you see your biggest blind spots around money. Because I believe a world in which womxn earn more money is a much better world.

Here are SOME patterns I’ve noticed that reveal hidden money capacity issues:

IMMEDIATE SHUTDOWN

Once, I spoke with a woman who kept exclaiming how ready she was for this capacity work. But when we got to the part where we talked about the different ways to work with me and investment levels, her energy radically shifted.

Money is an uncomfortable topic for most of us. So I always spend a little time helping people past their fears, so the decision comes from a grounded place and not a fearful place. Except she completely shut down.

I tried to help her lean into the discomfort, but it was like an impenetrable wall. She couldn’t even for one second allow herself to think of the many possibilities that existed for her to invest in what she wanted. It was just total shame, terror and rigidity. No “how could I make this happen”…nothing.

Now, you gotta let me in if you want the help to make more expansive money decisions, so I just ended the call and wished her well. But I thought about her for a long time. Because the way she reacted to her money situation was exactly what was happening in all of her life.

The entire reason she’d signed up to talk with me was that she’d reached a “comfortable” place in her life. Yet, she was wildly unsatisfied on a soul level. She knew she needed to go for her biggest dream, the one she’d carried in her heart for 10 years. But, she kept rigidly staying in place, living a life that was not big enough for her true desires.

She behaved the same way when it was time to finally invest in making her dream happen. Rigid. Shut down. Stagnant. To this day, I think of her, still sitting in her comfy home and life, with a heart aching to bust out of it’s comfort and a soul screaming to be heard. It breaks my heart.

A client at one of my retreats in France

I see women do this in so many other ways. They look at something and immediately assume it will be too expensive for them, so they don’t even inquire. Or they see a price tag, it feels out of reach to their ego and they immediately give up and don’t try to figure out how they can make it happen.

Or they write me and say “it seems this is only for entrepreneurs, and not women like me who work for other people” (when that is not the case at all, I work with women from ALL backgrounds and careers).

All of these ways are ways in which you shut down and disqualify yourself before even getting started. When if you’d just push yourself even an inch, everything would start moving and changing for the better.

The truth is, there are literally endless ways to make that happen for yourself, no matter how big your investment goal is. You have to be willing to think outside of your box. But if you shut down and think there are only a few ways to do this, then you’ll never get out of your vicious money capacity plateau/cycle.

That “shutdown” is a money capacity issue. If you’re shutting down like this over money, you’re doing it everywhere in your life.

SETTING “REALISTIC” MONEY GOALS

I’ll have to raise my hand for this one, as this is one I’ve finally just busted out of in the last few years. This one comes from trauma related to earning money and being disappointed.

If you’ve been here for a while, you’ll know my story of how I was on top of the world in 2014 with sold out and waitlisted programs out the wazoo and making more money than I’d ever made at that time.

Then, because I misdiagnosed my burnout as a strategy issue instead of a capacity issue, I made some changes to my business model that tanked my business in 2015 and put it in $100,000 of debt.

I spent the year after building things back up (successfully, thankfully, because by then I was prioritizing capacity like never before). But there was still a lingering effect from that traumatic year.

I’d do this thing where I would set my most desired financial goals, even tell my team and business mentor about it. But deep down inside I didn’t totally believe it would happen. So then I’d adjust the goal and say I was “making it more realistic.”

The trauma of 2015 made me afraid to dream big again. Dreaming big was exactly what had made my business and my clients so successful in the first place. Yet my ego would say “don’t dream big, look what happened in 2015” and “the shoe is always going to drop, so be careful.”

Guess what happens when you set goals with residual money trauma? You don’t reach them. It’s a self-fulfilling prophecy. Believing it was dangerous to dream big again made me make safe business decisions that kept things moving along, but didn’t really move the needle as much as I wanted.

It wasn’t until I did the money capacity work that I started to gain more confidence in my ability to reach my goals again, and that year, my revenue hit the highest mark ever.

If you aren’t setting REAL money goals and milestones because you’re scared you won’t achieve them, you’ve got a money capacity issue. A LOT of the time, what your ego is telling you is “realistic” is actually a capacity issue in disguise. It’s also an excellent way for your ego to keep you playing small and safe. Small and safe never changed the world.

Setting money goals from a place of unresolved trauma is a perfect way to set yourself up for an earning plateau. Because it’s actually not realistic or rational to set goals from that place. Fear is often IRRATIONAL and UNREALISTIC. You’ve got to expand your capacity so that you stop making money decisions from that place in your brain.

THE DEFENSIVE SPIRITUAL BYPASS

I spoke with a woman once who was very dissatisfied with her purpose She spent all her time managing her kids and was an amazing mama. But it came at a cost to her happiness and her purpose. And frankly, it was costing the world. Because the world NEEDS what she has to offer, but she wasn’t doing anything with it.

Once again, when we got to the money part of our conversation, fear came up. Then she had an interesting reaction that I call the “defensive spiritual bypass”.

“Well, you know there’s nothing wrong with being a stay at home mom. That’s a very noble endeavor. And you know, not all of us want to earn 100 million dollars, there’s nothing wrong with not having that goal. What kind of a mother would I be if I spent this money on myself and put my kids in jeopardy?”

All of these things came tumbling out of her mouth. I hadn’t said a word, mind you. Of course there’s nothing wrong with being a stay at home mom. Of course you don’t HAVE to have a $100 million dollar goal to be “worthy”. And her kids were NOT actually going to be in jeopardy if she invested in her capacity growth. (In fact, they’d actually get MORE of her in the end).

It was manufactured defensiveness to avoid facing her money capacity issue. She projected onto me that I had said or was thinking all those things and in doing so, talked herself out of moving forward with what she said she had wanted to do.

I’ve seen women do this in other ways, too. A few women I’ve spoken to have gone into a long monologue about “not wanting to be pressured like every other person does on these kinds of calls”.

Someone wanting to help you break past your money issues and someone pressuring you to invest against your will are two totally separate things. But it’s an excellent way to make the person trying to help you the “bad guy trying to pressure you” so that you are distracted and don’t actually face your money issues by doing something differently.

I’ve also seen people who can’t figure out how to make the money they want write defensive posts on social media about how “there’s nothing wrong with wanting a small life” and criticizing all people who want to make money as being “sucked into hustle culture”.

These are excellent ways to cover up the pain you feel over not reaching your true money goals. And if you find yourself doing any of the above, you guessed it, it’s a money capacity issue.

ACCEPTING THAT YOUR BANK ACCOUNT IS THE FINAL SAY

One of the most inspirational clients I’ve ever had taught me about this sabotage technique, because she almost fell prey to it, and then didn’t. Here’s what happened:

I spoke with Lynne last year. She was charging about $3000 for 6 weeks of work. Her work is powerful and world-changing and she knew she wasn’t charging enough money. Yet she was afraid to ask for more money.

When we spoke about the investment in one of my programs, she didn’t have the money in her bank account. Now, most people with this money capacity issue stop there. They say “well I don’t have it, so guess it’s just not for me”.

Think about that for a moment. So, if you walk up to your house and someone has moved in and claimed it as their own, would you just say “well, guess that house isn’t for me!” Do you honestly give up that easily in the face of your dreams?

If you really wanted to have a child, would you just say “guess kids aren’t for me” after trying once and not getting pregnant? If you wanted your soulmate, you would go on just a few dates and then give up?

Lynne didn’t. I gave her a challenge. Come back with your deposit within 36 hours. She sounded VERY doubtful she could achieve that when we got off the phone. But within 36 hours…

A client during at a retreat in Santa Barbara

….she had the money, and not just the deposit, the FULL amount.

I’ll never forget the emails I got from her. “Having to do that stretched my thinking in a way I have never done before. I was DETERMINED to get that money, and because I was so set on it, I did. Honestly, just having to come up with the money to do this program has already given me the entire value of the program before it’s even started”

I’ve seen lots of people SAY they’re determined to not be limited by their bank account. But because they have money capacity issues, they go into “creating the money” from a place of desperation or with a belief underneath that it’s not going to happen. So that’s exactly what happens.

NOT ONE woman who I have worked with just had the money laying around in their account. But they made it happen. And interestingly enough those are the women I see go on to have great success. Because in order to have great success, you have to think beyond your perceived limits, like bank account amounts. Or whether or not women are “allowed” to be in certain spaces, etc…

Lynne has gone on to book several $50,000 and $65,000 contracts since breaking out of her “it’s not in my bank account” mentality. And it’s exactly BECAUSE she broke out of that mentality that she KNOWS she can ask people for $65,000 contracts.

When you really want it, there is always a way. Your soul is never a yes to something you can’t actually do. It’s just a matter of how willing you are to do what you say you want to do. Being always limited by your bank account is money capacity issue and it’s exactly why your money isn’t growing like you want it to.

YOU decide what’s in your bank account and when you have FULL AGENCY over that, then what you want to see will finally line up for you.

….

So do you want to know what it’s like to have FULL AGENCY over your money and know that you can create it whenever you need to?

Did you see yourself in any of the above and think “HOW do I break out of that?”

The answer is: expanding your money capacity.

ALL of the above are money capacity issues. Until you resolve these issues, you are going to see a slowdown in your ability to continuously earn, save and invest more and more money.

There is really no way around it.

That’s exactly why I created my virtual Money Capacity retreat – to begin this process of shifting these sabotaging money behaviors AT THE CORE.

This is your LAST CHANCE to sign up for tomorrow’s virtual Money Capacity retreat. There are only TWO spots left now!

If you can’t make tomorrow, we have one more date left.

In love and capacity,

Lisa Fabrega

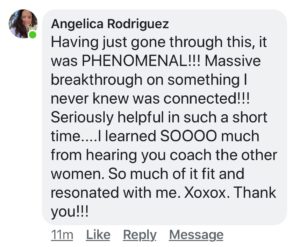

Ps: here are some screenshots of amazing things women have said after attending the retreat. Cause I know sometimes we want a little “social proof”