lisa fabrega

Every year, hundreds of people book sessions with me to explore working together. At the end of those calls, we always talk about money/what they want to invest in Capacity Work™. After ten years of these calls, I’ve learned A LOT about sneaky ways we sabotage and even reject money.

Observing the way a person reacts to the money part of that exploratory conversation often shows me why they’re experiencing money plateaus in the first place. It also tells me how and when they’ll plateau financially if it hasn’t happened already.

Wanna know what I’ve learned? Here are SOME patterns I’ve noticed that reveal hidden Money Capacity issues (see if you can see yourself in some of these):

IMMEDIATE SHUTDOWN

Once, I spoke with a woman who was all gung ho about signing up for Capacity Work. But when we talked about money and investing in it, her energy radically shifted.

Money can be an uncomfortable topic. So, I tried to help her past her fear. I wanted her investment decision to come from a grounded place vs. a fearful one. Except she completely shut down.

She was like an impenetrable wall. She couldn’t allow herself to think of the many possibilities for how she could come up with the investment. No “how could I make this happen”… nothing.

The way she reacted to our money conversation was exactly what was happening in her life and work. She’d booked a call with me because she’d reached a “comfortable” place in her life and business. Yet, she was unsatisfied. She knew it was time to make a big, radical move. But, she kept rigidly staying in place, running a business and living a life that was not big enough for her true desires.

She behaved the same way when it was time to finally invest in making her dream happen. Rigid. Shut down. Stagnant. To this day, I think of her, still in her comfy home and life, with a soul aching to shake things up. It breaks my heart.

I see women do this in so many other ways.

- You look at something and immediately assume it will be too expensive for you, so you don’t even inquire.

- You see a price tag, it feels out of reach or more than what you’re used to investing and immediately give up and don’t try to figure out how you could make it happen.

- Or you disqualify yourself before even inquiring. I get at least five messages a week like this that say “I love capacity work but I’m not sure it’s for me because I assume you only work with x kind of people.” (Not true, I work with people of all careers and businesses, but it’s a good excuse your ego creates to justify staying comfortable where you are.)

Those are Money Capacity red flags.

Do you honestly believe so little in your ability to make things happen? I know you can move mountains! You shut down, dig in your heels and disqualify yourself before even starting. When if you’d push yourself just an inch, everything would start moving and changing for the better.

If you’re shutting down like this over money, you’re doing it everywhere in your life. That’s a Money Capacity issue.

SETTING “REALISTIC” MONEY GOALS

This one comes from trauma caused by aiming high in the past and not reaching the money goal you set. I once worked with a client who’d had a totally sold out business. But because she hadn’t worked on her capacity, she’d developed physical symptoms and burned out at the end of her most successful year.

She misdiagnosed her burnout as a strategy issue instead of a money capacity issue. Hired a business coach to “fix her business model” (even though I knew her business model wasn’t what led to her burnout). That didn’t work and she ended the next year with 50% less revenue than the year before. That big financial crash was traumatic and left her with a huge dent in her confidence.

As we worked together, I noticed she’d set big financial goals like she used to, but then a few weeks later she’d adjust the goal to “make it more realistic.” The trauma of her bad year froze her in time and made her afraid to dream big again. But dreaming big was exactly what had made her so successful. She wasn’t using her most potent money-making tool.

Guess what happens when you set goals with residual money trauma? You don’t reach them. It’s a self-fulfilling prophecy. You make overly safe decisions that don’t move the needle that much. Or you make a certain amount and then plateau at your “safe earning level.”

Through Money Capacity work, we recalibrated her nervous system around her money trauma, and she ended up having one of her most profitable years ever. No business model rewrites needed. Just money capacity shifts.

THE DEFENSIVE SPIRITUAL BYPASS

I spoke with a woman once who spent all her time managing her kids and was an amazing mama. But it came at a cost to her happiness and her purpose. The world NEEDS what she has to offer, but she wasn’t putting it out there. It was causing her to feel stuck and depressed.

When we got to the investment part of our exploratory session, she had an interesting reaction. She’d gotten so used to putting herself last, that when the time came to put herself first in the ONE area she could, she felt fear and her ego backtracked her.

Instead of admitting out loud that she was afraid so we could work through it, she did what I call the “defensive spiritual bypass.”

“There’s nothing wrong with being a stay at home mom. It’s a noble endeavor. And not all of us want to earn 100 million dollars, there’s nothing wrong with not wanting that. What kind of a mother would I be if I spent this money on myself and put my kids in jeopardy? Is that what you’re implying I do?”

Mind you, I never said it’s wrong to be a stay at home mom. Never said ANY of the things she was rebutting. Really, it was her conversation with her own self-judgments being projected onto me as the bad guy shaming her. This was a clever tactic by her ego to justify once again giving up on her dreams and going back to putting herself last. Manufactured defensiveness to avoid facing her Money Capacity issue.

A few women I’ve helpfully pointed out that behavior have gone into a long monologue about “not wanting to be pressured.” Someone wanting to help you break past your money issues and someone pressuring you to invest against your will are two totally separate things. But to accuse people who’re trying to help you see your blindspots of “pressuring you” is an excellent way to avoid seeing and healing blindspots.

The defensive spiritual bypass is a clever way your ego covers up your pain over not reaching your deeply desired money goals. And if you find yourself doing any of the above, it’s a Money Capacity issue.

ACCEPTING THAT YOUR BANK ACCOUNT IS THE FINAL SAY

One of the most inspirational clients I’ve ever had taught me about this sabotage technique, because she almost fell prey to it, and then didn’t. Here’s what happened:

When I spoke with Lynne, she was charging $3,000 for 6 weeks of work. Her work is world-changing and she knew she wasn’t charging enough money. Yet she was afraid to ask for more.

When we spoke about the investment in one of my programs she felt called to attend, she didn’t have the money in her bank account. Now, most people with this Money Capacity issue stop there. They say, “Well I don’t have it, so guess it’s just not for me.”

Think about that for a moment. So, if you walk up to your house and someone has moved in and claimed it as their own, would you just say, “Well, guess that house isn’t for me!” Do you honestly give up that easily in the face of your dreams?

If you really wanted to have a child, would you just say, “Guess kids aren’t for me” after trying once and not getting pregnant? If you wanted your soulmate, would you go on just a few dates and then give up?

Lynne didn’t. I gave her a challenge. Come back with your deposit within 36 hours. She sounded VERY doubtful she could achieve that when we got off the phone. But within 36 hours she had the money, and not just the deposit, the FULL amount.

I’ll never forget the emails I got from her. “Having to do that stretched my thinking in a way I have never done before. I was DETERMINED to get that money, and because I was so set on it, I did. Honestly, just having to come up with the money to do this program has already given me the entire value of the program before it’s even started.”

NOT ONE woman who I’ve worked with had all the money laying around in their account. But they made it happen. And interestingly enough those are the women who go on to have great success. Because in order to have great success, you have to think beyond your perceived limits, like bank account amounts. Or whether or not women are “allowed” to be in certain spaces, etc.

Lynne has gone on to book several $50,000 and $65,000 contracts since breaking out of her “it’s not in my bank account” mentality. And it’s exactly BECAUSE she broke out of that mentality that she KNOWS she can ask people for $65,000 contracts.

When you really want it, there is always a way. Your soul is never a ‘yes’ to something you can’t actually do. It’s just a matter of how willing you are to do what you say you want to do. Being always limited by your bank account is a Money Capacity issue and it’s exactly why your money isn’t growing like you want it to.

….

So do you want to know what it’s like to have FULL AGENCY over your money and know that you can create it whenever you need to?

Did you see yourself in any of the above and think, “HOW do I break out of that?”

The answer is: expanding your Money Capacity.

That’s exactly why I created the virtual Money Capacity retreat — to begin this process of shifting these sabotaging money behaviors AT THE CORE.

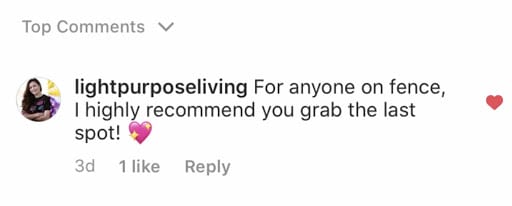

This is your LAST CHANCE to sign up for the LAST virtual Money Capacity retreat on March 20th. There is only ONE spot left now!

In love & capacity,

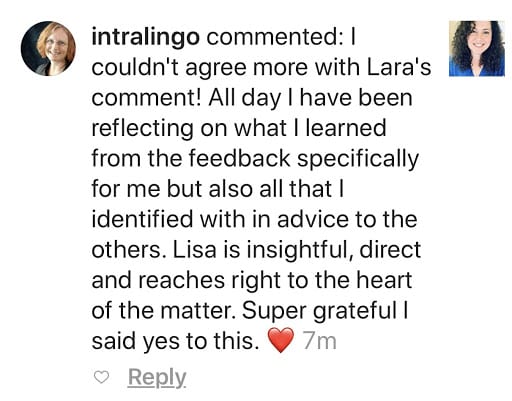

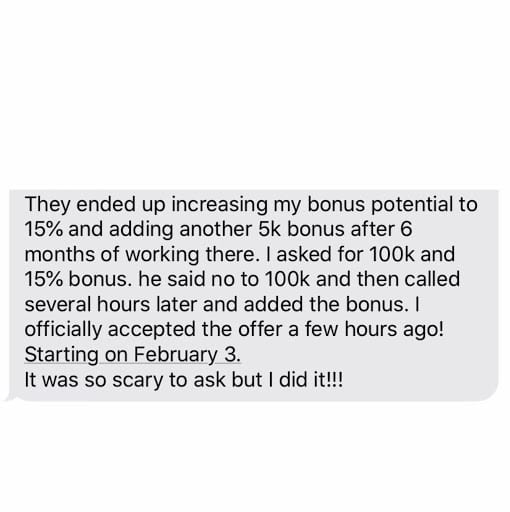

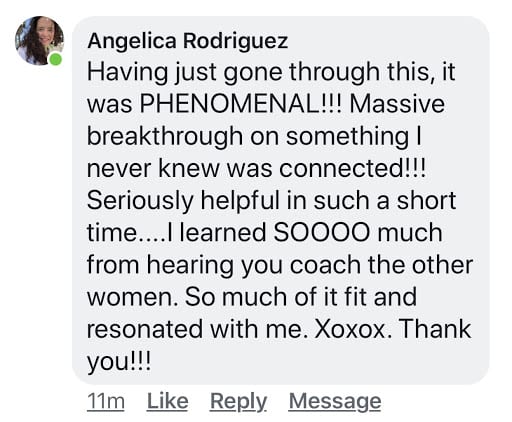

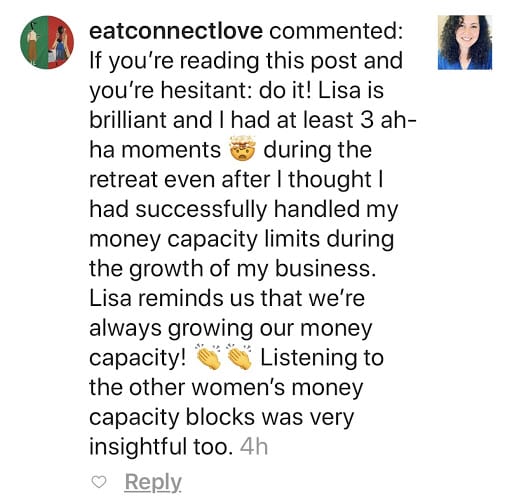

PS: Here are some screenshots of amazing things women have said after attending the retreat. Because I know sometimes we want a little “social proof.”